Sign-up now!

Keeyns Academy | Webinar

Start working smarter with Automated Tax Workflows

It’s everyone’s New Year’s resolution: become more efficient so there’s time for new projects and innovation.

But what if we told you that the 28% of your workweek spent on emails could be reduced by at least half? It starts with automating your workflows.

-

What are Automated Workflows?

An automated tax workflow is a digital, step-by-step process that uses software to manage and execute tax-related tasks automatically — instead of relying on emails, spreadsheets, and manual document exchanges. Recurring activities across the tax lifecycle are handled in a consistent, timely, and controlled way.

-

Why do you need automation?

Because the future brings more compliance, more filings, and increasing use of AI — all of which require clean data and structured processes to work smarter.

-

How do you start with Automated Workflows?

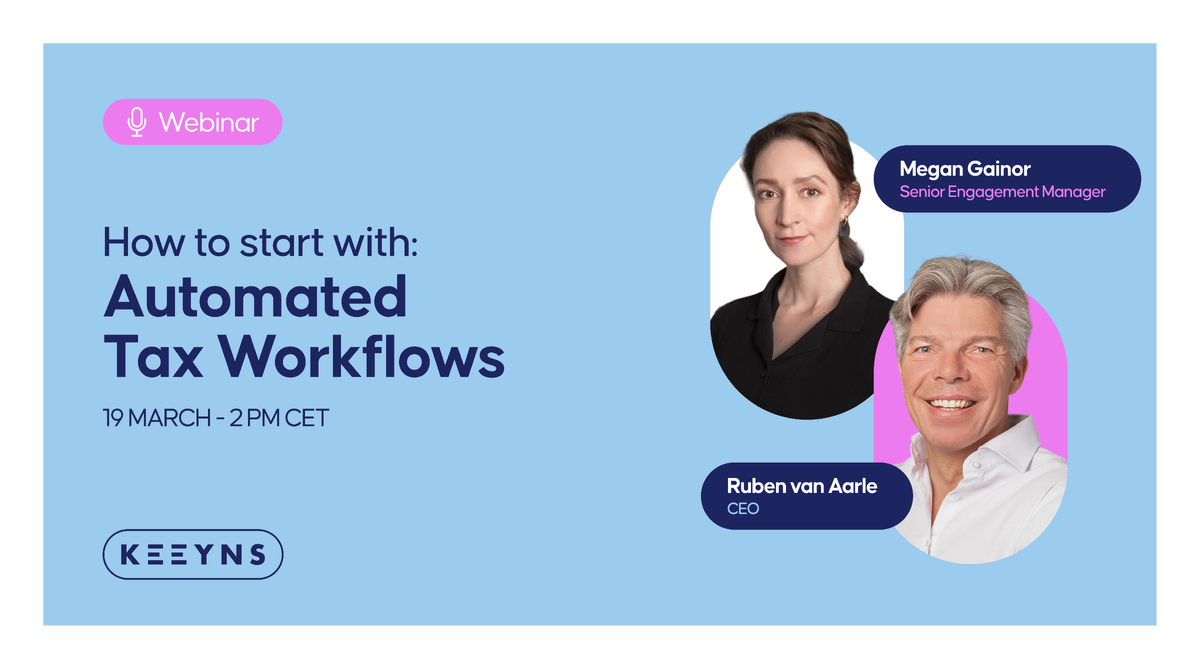

That’s exactly what our CEO Ruben van Aarle and Customer Success Manager Megan will cover during this webinar on the 19th of March at 2 PM CET.

Megan Gainer

Senior Engagement Manager

Since 2024, Megan has been onboarding customers to the Keeyns platform and helping them build a solid foundation for automation. She knows all about the building blocks and the best way to implement them.

If anyone knows how to get automation right from the start, it’s her.

Ruben van Aarle

CEO & Co-founder

With 25 years of experience in tax, Ruben has faced the frustration of endless emails, filings, and missing spreadsheets. Since co-founding Keeyns, he has been helping tax professionals build a solid foundation for automation.

If anyone knows how to tackle tax processes efficiently from the start, it’s him.