Are you ready to automate your tax wokflows?

Sign-up now!

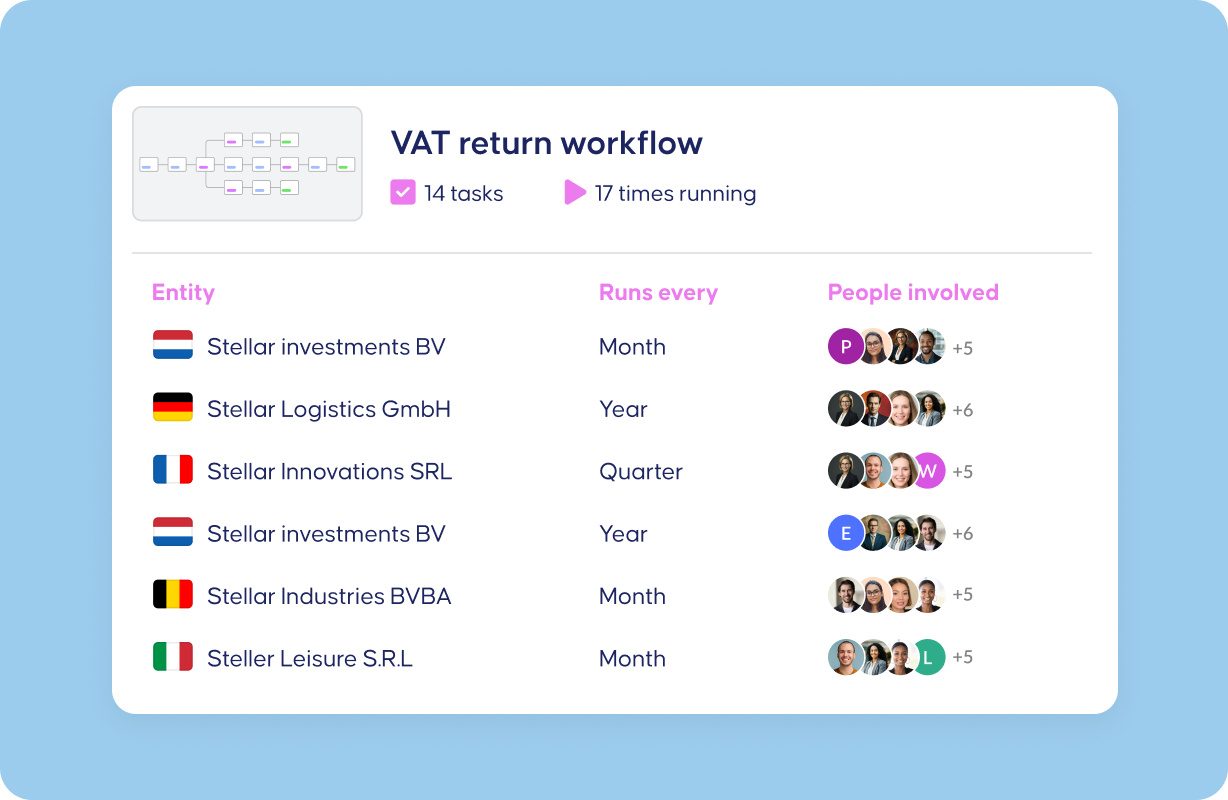

Automate the handoffs, approvals, and follow-ups that slow your team down. Free up time and reduce risk across every entity.

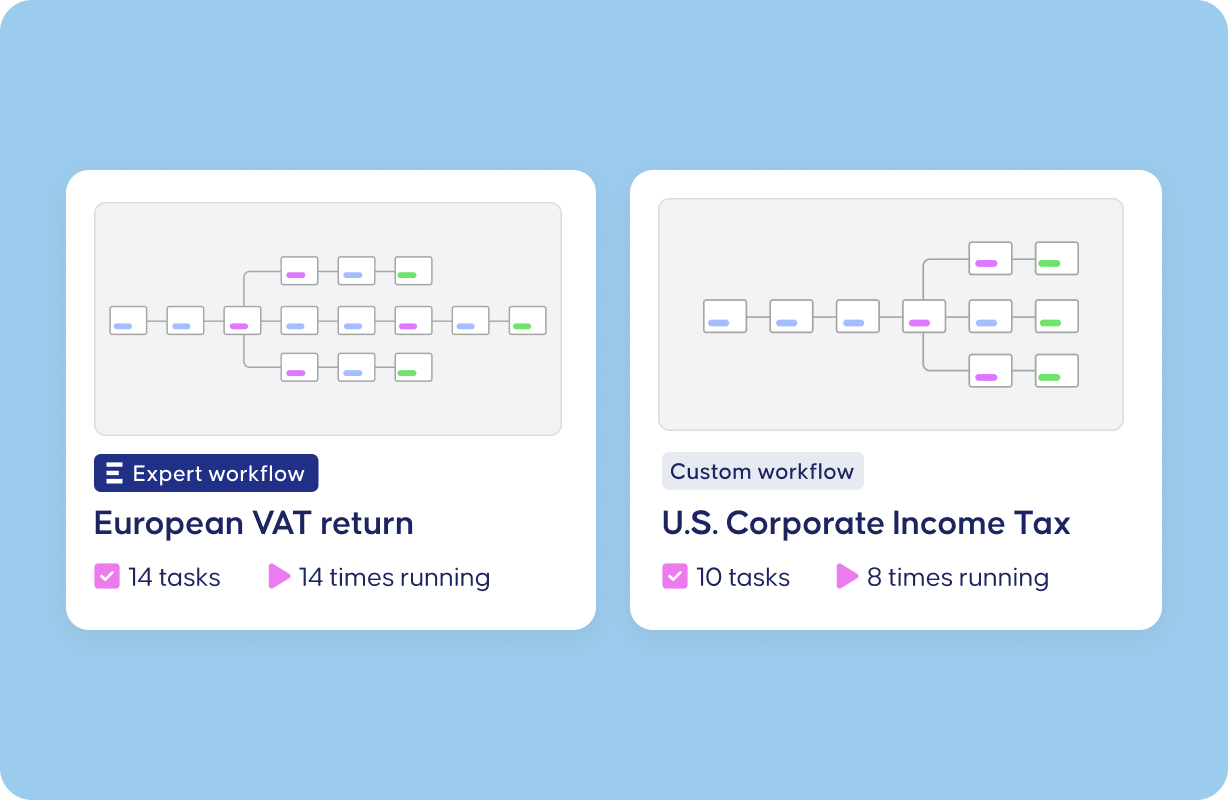

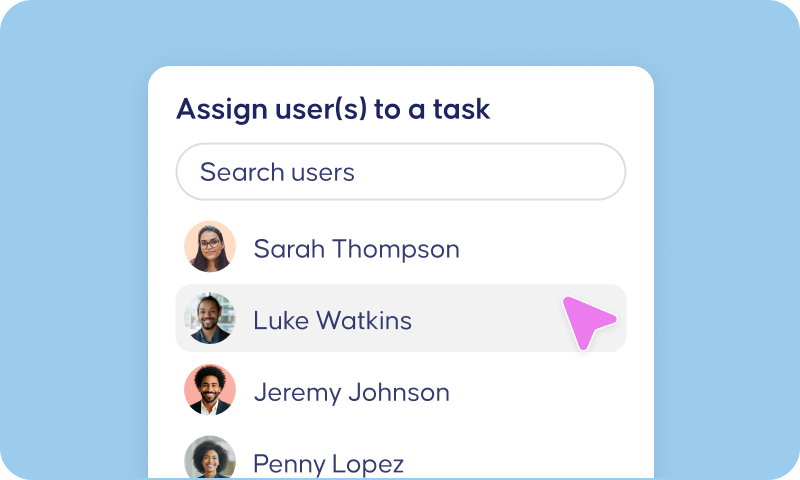

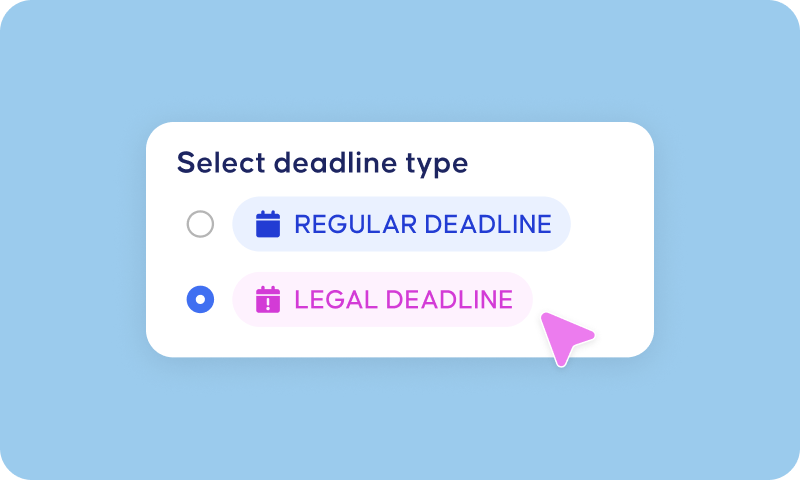

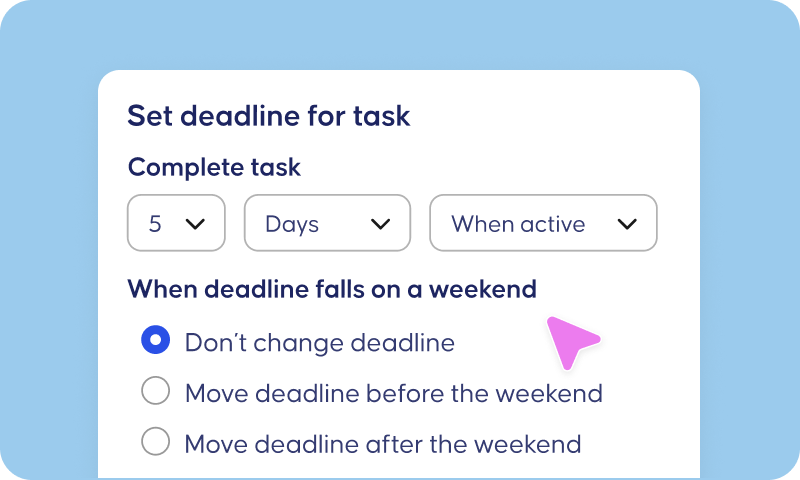

Keeyns' workflow automations eliminate manual follow-ups and process gaps. Ensuring every task moves forward on time, with the right owner.

Breakdowns in workflow cost time, trust, and control. Keeyns eliminates the chaos; automating tasks, flagging risks, and standardising execution. What follows? Focused teams. Consistent processes. Confident decisions.