Take the test and find out!

The Keeyns Platform

Seamlessly manage tax compliance with our Tax Collaboration Platform

Ensure compliance and streamline tax processes with the help of expert-validated workflows, seamless collaboration, and clear reporting.

Our platform's impact

Worldwide compliance made simple

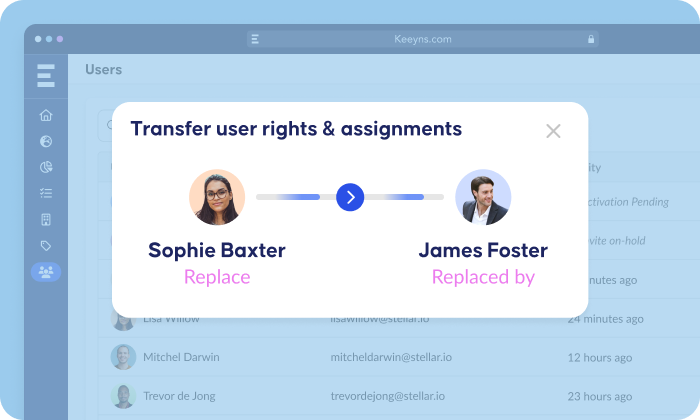

Ensure continuity and maintain knowledge

Easily manage roles & rights within the platform, with a clear segregation of duties. The platform serves as your one-source-of-truth on tax matters.

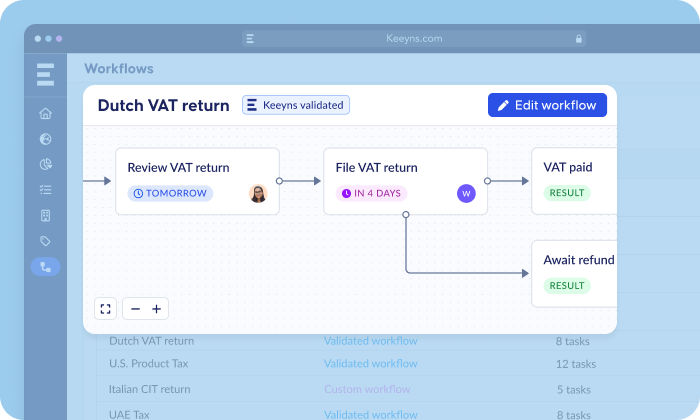

Expert-validated workflows

Streamline tax filings, data collection, and reporting with expert-validated workflows. Reducing the risk of errors and missed deadlines.

Features of Keeyns

Dashboards visualize your organization's compliance through consolidated metrics and status indicators.

Streamline work with our Microsoft integration

Why customers love using our platform

A no-brainer investment

ISO 27001

Microsoft cloud-based storage

Special encryption per client

GDPR Certified

Made for Tax Experts

by Tax Experts

Keeyns was founded in The Netherlands in 2017 by former experienced international tax partners and inhouse tax directors who felt the pain – first hand – of uncontrolled tax processes and decentralized tax data storage.

Resources

Dive into the latest news, must-read articles, and expert insights. Access top resources, including whitepapers, guides, and tools, designed to help you navigate global tax challenges.