Sign-up now!

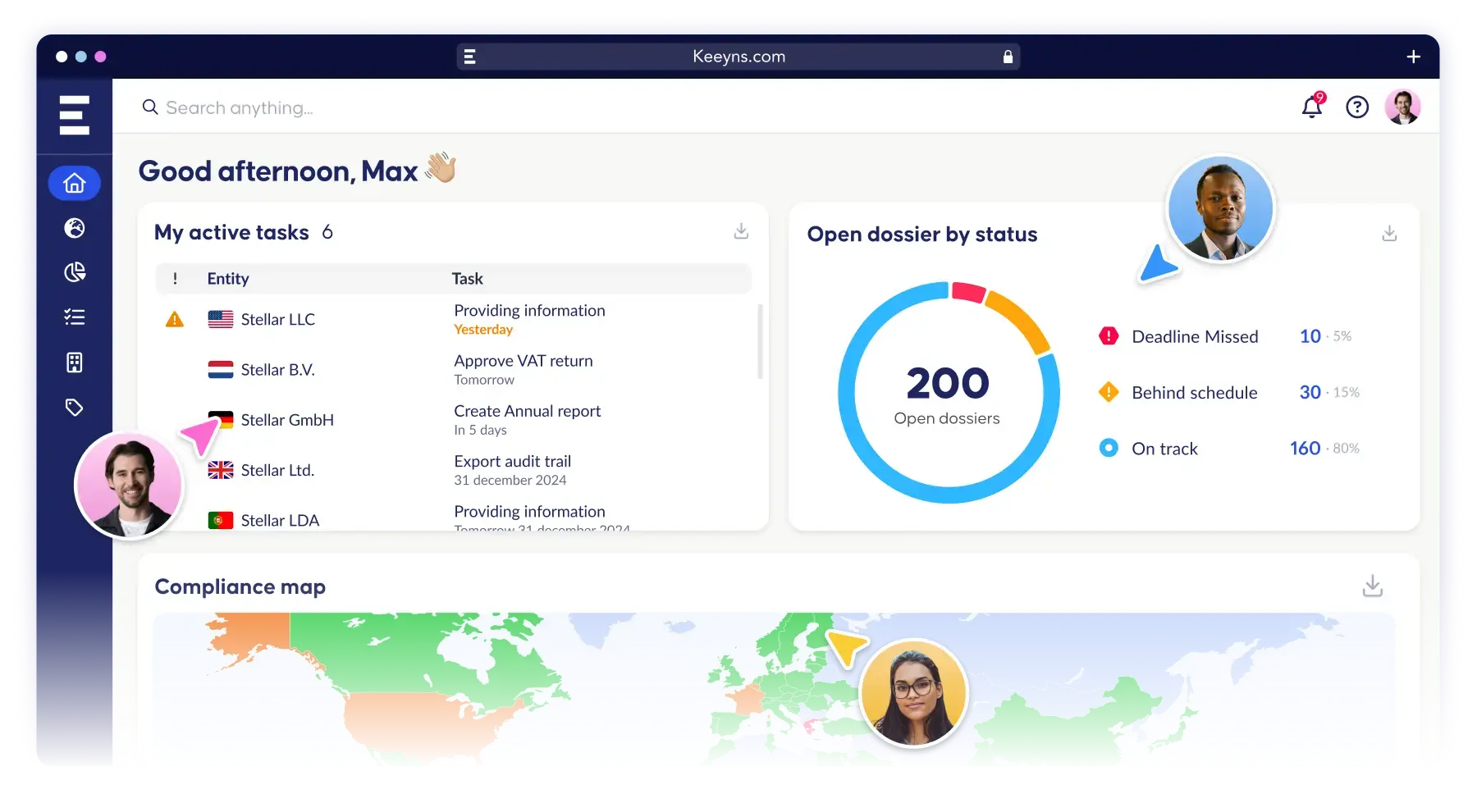

Total confidence in every tax process

Keeyns centralises tax operations for international and multi-entity companies.

One platform connecting workflows, documents and governance for total visibility and control.

Trusted by finance and tax teams globally

Tax has a Visibility & Control challenge

No more manual spreadsheets, missed deadlines or audit anxiety. Finally.

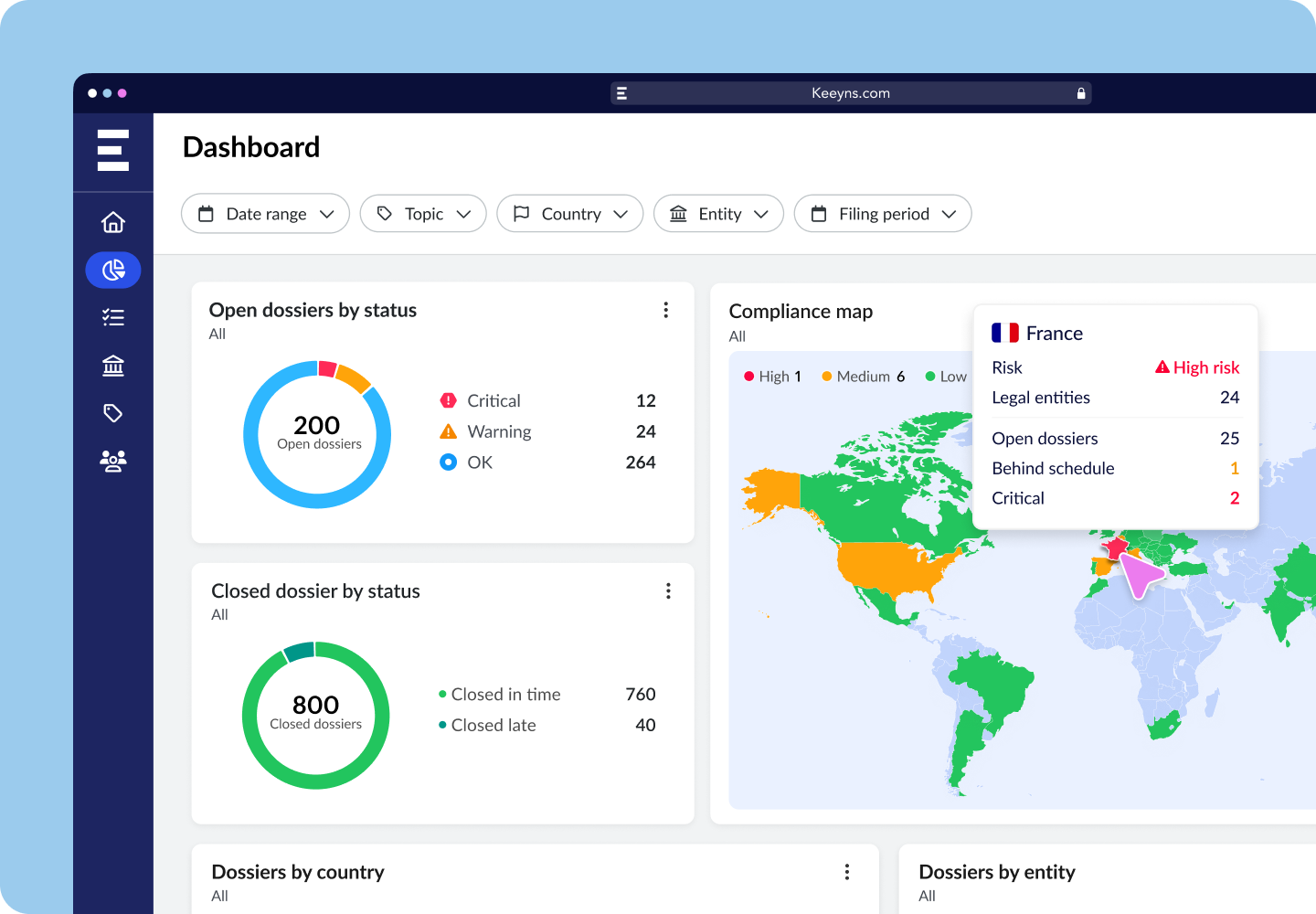

Monitor tax compliance with a clear overview

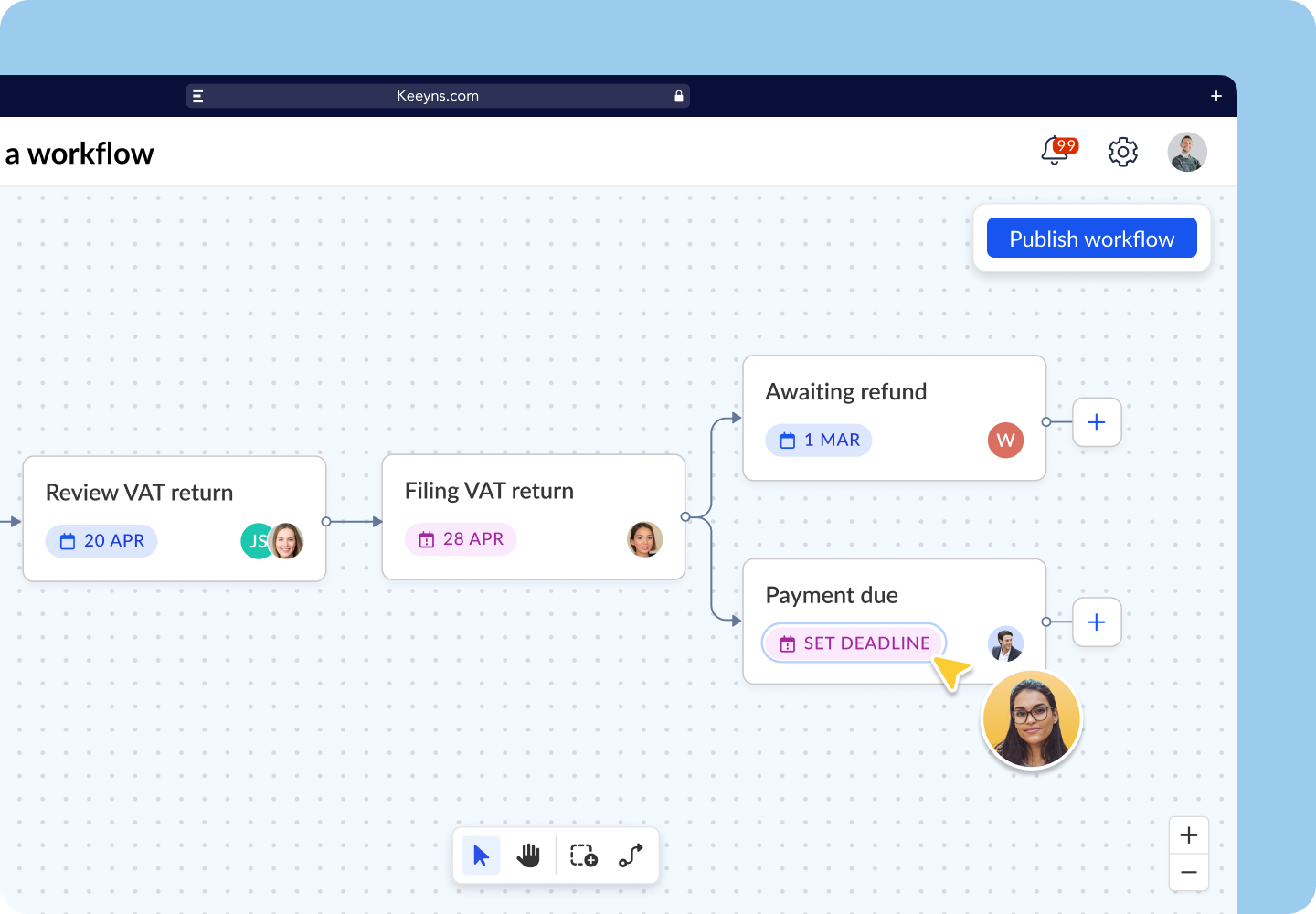

Streamline your tax processes with workflows

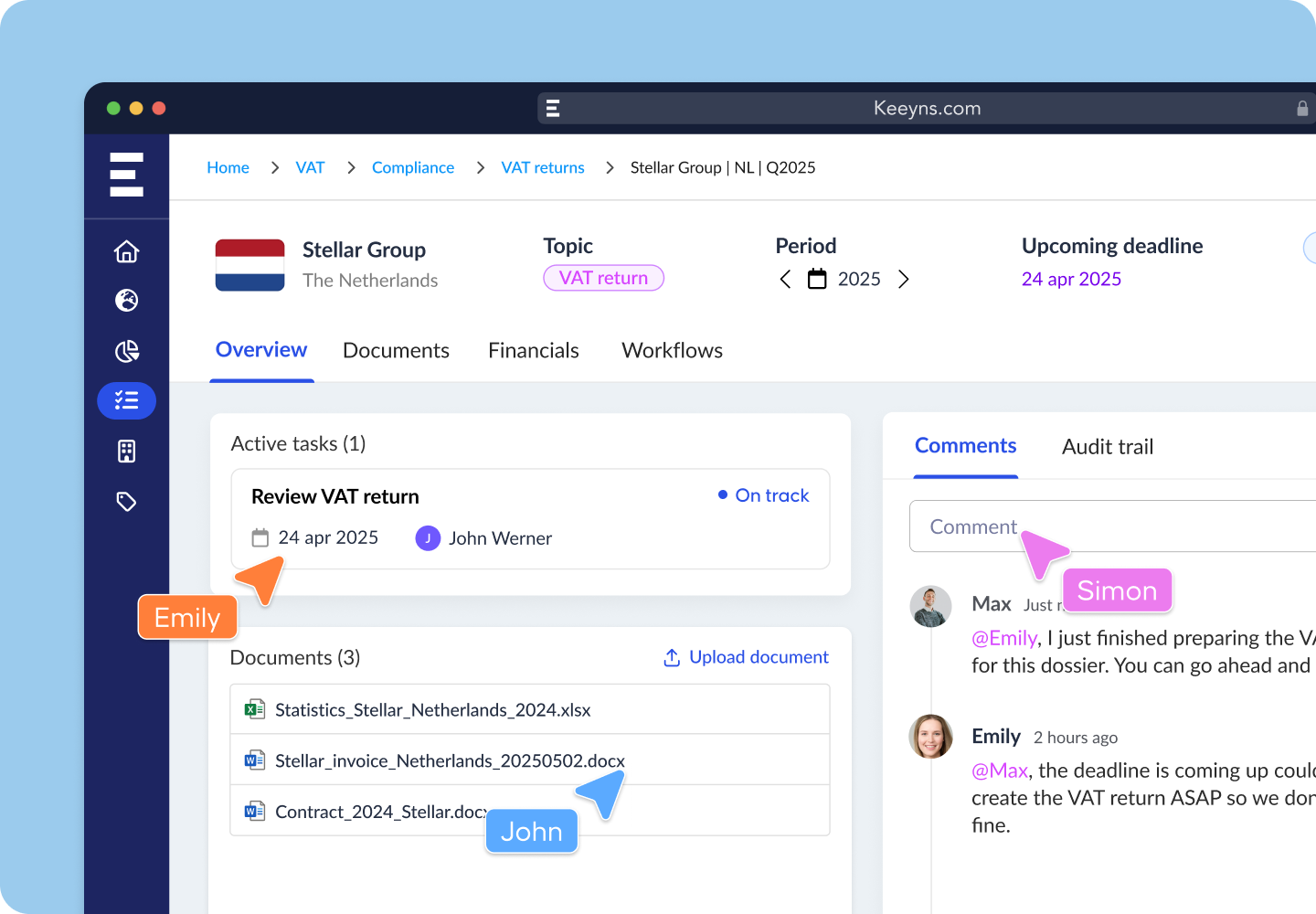

Collaborate with in-house teams and external advisors

Never knew we had so many compliance requirements. Still 25 filings left this month... All converted into Keeyns, getting there. Beautiful compliance overview!

The team needed a solution to automate and streamline our tax processes, Keeyns ensures timely compliance and facilitating the management of documents and deadlines across multiple jurisdictions.

So many other tools seemed like a gilded cage—expensive and restrictive. With Keeyns, we found the freedom to collaborate with our advisors, while having the ability to own our data and be in full control.

One platform for all stakeholders

CFO

Ensure tax transparency and align with business goals.

Tax director

Gain actionable insights to strategize effectively.

Tax specialist

Automate repetitive tasks and focus on adding value.

External advisor

Collaborate seamlessly with in-house teams.

Worldwide compliance was never so easy

Worldwide coverage

Manage global operations with ease. One platform for compliance, reporting and complete oversight.

Local tax topics

From VAT to wage tax, the platform supports many topics and lets you add your own.

Global currency support

The platform helps you handle tax and reporting in the currency you need.

Our commitment to data security

ISO 27001 certified

Microsoft cloud-based storage

Special encryption per client

GDPR Certified